As the global economy continues to evolve, the demand for reliable and efficient logistics services has never been more pressing. United Parcel Service, Inc. (NYSE:UPS), one of the world's largest package delivery companies, has been a stalwart in this industry for decades. Despite its strong fundamentals, UPS stock has been trading at a relatively low valuation, making it an attractive opportunity for investors. In this article, we will delve into the technical analysis of UPS stock and explore why it may be too cheap to ignore.

Technical Indicators Point to a Buying Opportunity

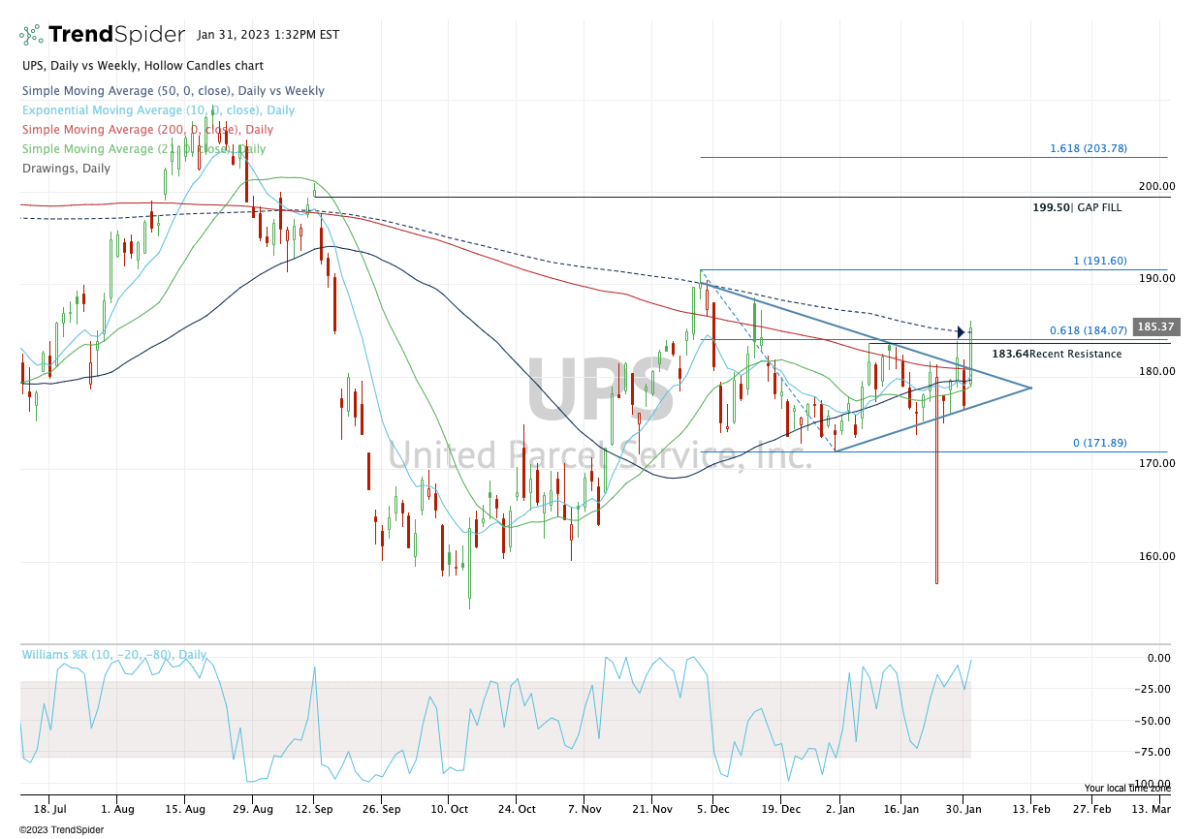

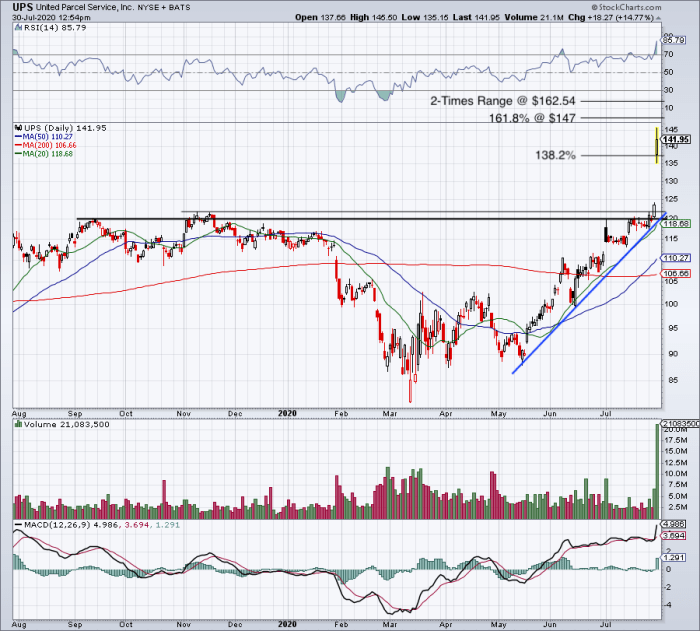

From a technical perspective, UPS stock has been experiencing a period of consolidation, with the price action forming a clear uptrend over the past year. The stock's Relative Strength Index (RSI) has been oscillating between 30 and 70, indicating a neutral sentiment among investors. However, the Moving Average Convergence Divergence (MACD) indicator has been showing a bullish crossover, suggesting that the stock may be poised for a breakout.

Furthermore, the Bollinger Bands have been tightening, indicating a decrease in volatility and a potential increase in trading activity. The stock's price has also been trading above its 200-day moving average, a key indicator of long-term trend direction. These technical indicators collectively suggest that UPS stock may be due for a rally, making it an attractive buying opportunity for investors.

Fundamental Analysis Supports the Bullish Case

In addition to the positive technical indicators, UPS's fundamental analysis also supports the bullish case. The company has a strong track record of generating consistent revenue growth, with a 5-year average annual revenue growth rate of 4.5%. UPS's operating margin has also been expanding, driven by its ongoing efforts to improve efficiency and reduce costs.

The company's dividend yield of 3.5% provides a attractive income stream for investors, while its debt-to-equity ratio of 1.4 indicates a manageable level of debt. With a forward price-to-earnings ratio of 15.6, UPS stock is trading at a discount to its industry peers, making it an attractive value play.

Industry Trends Support Long-Term Growth

The logistics industry is expected to continue growing in the coming years, driven by the rise of e-commerce and the increasing demand for fast and reliable delivery services. UPS is well-positioned to capitalize on this trend, with its extensive network of delivery hubs and its investments in emerging technologies such as drones and electric vehicles.

The company's strategic partnerships with major e-commerce players, such as Amazon and Walmart, also provide a strong foundation for long-term growth. As the global economy continues to evolve, UPS's diversified revenue streams and strong brand reputation will enable it to maintain its market leadership position.

In conclusion, UPS stock presents a compelling buying opportunity for investors, with both technical and fundamental analysis supporting the bullish case. The company's strong track record of revenue growth, expanding operating margin, and attractive dividend yield make it an attractive value play. With the logistics industry expected to continue growing in the coming years, UPS is well-positioned to capitalize on this trend and deliver long-term returns to shareholders. As such, investors should consider adding UPS stock to their portfolio, as it may be too cheap to ignore.

Note: This article is for informational purposes only and should not be considered as investment advice. Investors should always conduct their own research and consult with a financial advisor before making any investment decisions.